The hidden cost of the wrong structure: what Australian startups get wrong early

Startups move fast—ABN, bank account, build.

But one decision quietly shapes everything that follows: your business structure.

It influences your tax position, whether investors can back you cleanly, and how exposed your personal assets are if something goes wrong. ASIC and business.gov.au both emphasise that different structures carry different legal, tax and reporting obligations.

At 42 Advisory, we work with founders across Melbourne — from SaaS startups and crypto ventures to medical and property innovators — helping them choose and evolve the right financial structure for growth.

Because while great ideas drive success, the right accounting architecture sustains it.

What is startup accounting?

Startup accounting combines compliance, tax planning and reporting systems so founders can scale, stay investor-ready, and meet ATO obligations.

Startup accounting is more than compliance. It brings together tax intelligence, financial systems and growth planning so a young business can scale efficiently, stay investor-ready and meet its ATO and ASIC obligations.

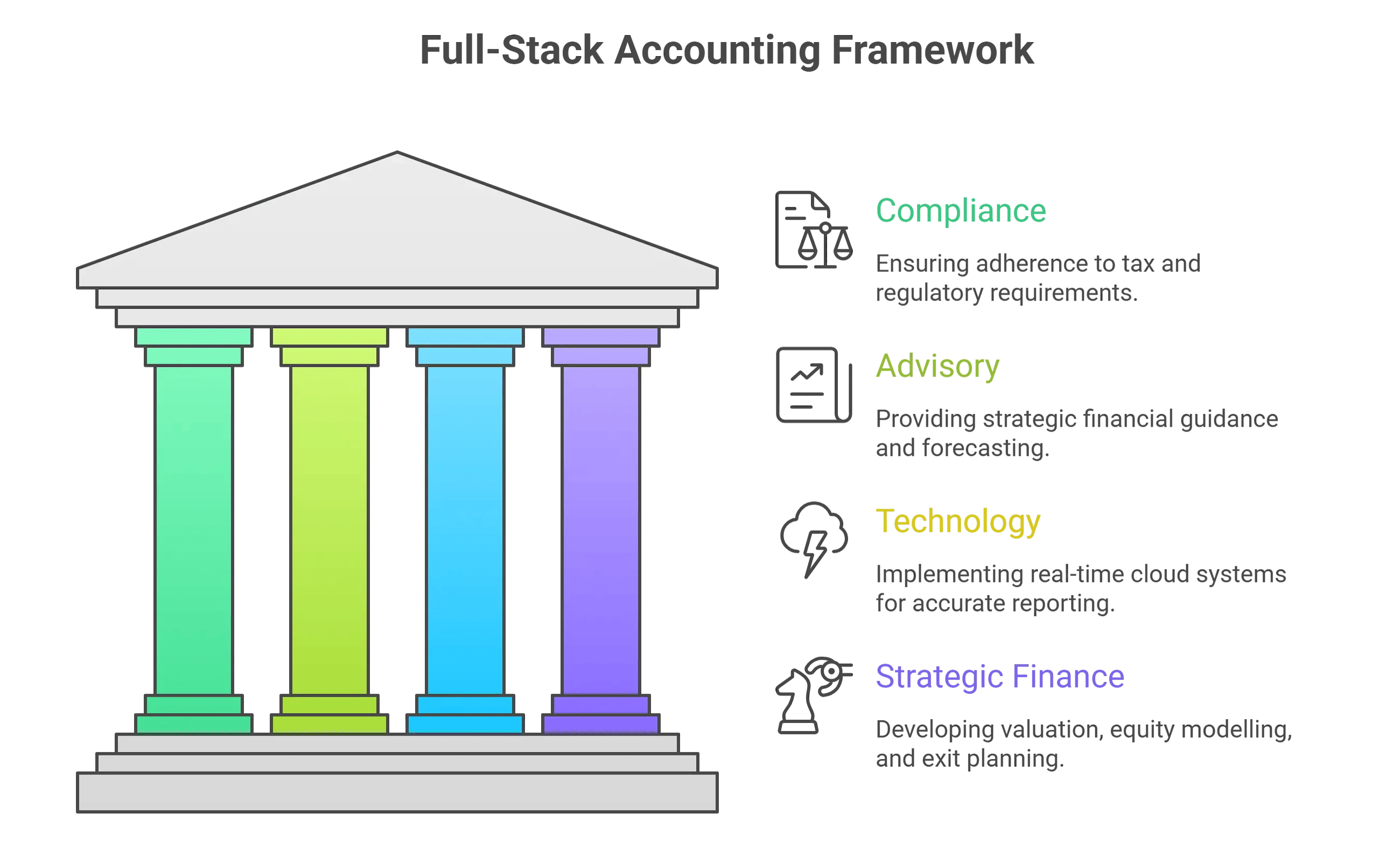

At 42 Advisory, we call this Full-Stack Accounting: a practical model that links day-to-day compliance with forward-looking decision support.

It covers:

-

Compliance – BAS, PAYG, GST, ASIC filings

-

Advisory – forecasting, capital strategy, R&D guidance

-

Technology – real-time cloud systems for accurate reporting

-

Strategic finance – valuation, equity modelling, and exit planning

In short, you get a finance system that grows as fast as your business does.

What business structure should an Australian startup choose first?

Most startups start with a Pty Ltd when seeking funding, hiring, or IP protection; sole trader suits low-risk testing only.

Your structure affects:

-

Tax obligations and opportunities – including CGT concessions and R&D

-

Asset protection – separating personal and business risk

-

Funding flexibility – attracting investors and issuing equity

-

Succession and scalability – preparing for future restructuring

Many founders begin as sole traders or partnerships for simplicity, but quickly hit structural limits as they grow, seek funding, or onboard staff.

A well-planned structure ensures you don’t outgrow your foundation before your business takes off.

When does a startup outgrow a sole trader or partnership?

If turnover rises, staff join, contracts grow, or investors appear, moving into a company early avoids messy fixes and personal exposure.

Founders typically “hit the wall” on early structures when:

-

You begin employing staff (PAYG, super and systems lift quickly)

-

You sign contracts with indemnities, warranties, or meaningful liability

-

You want to bring on an investor (or issue options)

-

You need a clearer separation between business risk and personal assets

Sole trader and partnership setups are often fast, but the transition cost later can be high—especially if IP, contracts, or customer relationships have already formed under the wrong entity.

How do sole traders, partnerships, companies, and trusts compare?

A company gives limited liability and cleaner equity; trusts can protect assets and split income, but add cost and complexity for startups.

| Structure | Advantages | Limitations | Best For |

|---|---|---|---|

| Sole Trader | Simple setup, full control, minimal cost | No asset protection, taxed up to 45% | Early-stage founders testing an idea |

| Partnership | Shared ownership, combined resources | Joint liability, complex tax reporting | Co-founders with aligned interests |

| Company (Pty Ltd) | Limited liability, lower tax (25%), R&D and SBE concessions, investor-ready | Higher setup/admin cost, ASIC compliance | Growth-stage startups and tech ventures |

| Trust (Discretionary / Unit) | Asset protection, flexible income distribution | Complex compliance, setup costs | Family-owned or IP-heavy startups |

What tax outcomes does structure change?

Structure drives tax rate, R&D access, and exit CGT; base rate entities can pay 25% company tax, while individuals may face top rates.

Structure affects tax in three high-impact areas:

1) Ongoing tax rate and profit extraction

Companies that qualify as base rate entities apply the 25% company tax rate, while others apply 30%.

Sole traders are taxed at individual marginal rates, which can be much higher at the top end.

2) Incentives and concessions

Eligibility for certain concessions can depend on how the activity is carried on and how records are maintained. (This is where “structure + systems” matters, not just structure alone.)

3) Exit tax (CGT outcomes)

Exit planning isn’t just “future you’s problem”. The wrong structure can limit access to concessions or make eligibility harder to prove.

Key tax and legal considerations for startups

1. Asset protection

“Individuals who carry on business as sole traders cannot protect their personal investments from the claims of business creditors.”

At 42 Advisory, we often recommend a company or trust structure once the startup begins trading or employing staff — ensuring founders’ personal assets are shielded from operational risk.

2. Small Business CGT Concessions

If your business grows and you eventually sell or exit, certain structures can unlock significant capital gains tax relief.

The small business CGT concessions under Division 152 include:

-

15-year exemption (if owned continuously for 15 years)

-

50% active asset reduction

-

Retirement exemption (up to $500,000 tax-free)

-

Small business rollover (deferring CGT to reinvest)

Eligibility depends on your turnover and net asset value tests.

These rules often determine whether founders pay 0% or 47% tax on exit — making structure a financial decision, not just a legal one.

3. Restructure roll-over relief

Startups evolve quickly.

If you begin as a sole trader or partnership, you can later restructure into a company without triggering CGT, provided there’s no change in ultimate ownership.

This is called the Small Business Restructure Roll-over (SBRR) — a relief designed to support genuine growth transitions.

42 Advisory assists founders through this process to ensure the move is both compliant and tax-neutral.

Building your financial stack

Choosing a structure is only the start.

To operate efficiently, your accounting systems should work as one integrated “stack” — enabling real-time insights and proactive decision-making.

Our startup stack typically includes:

-

Xero for accounting and bank reconciliation

-

Hubdoc or Dext for receipt capture

-

Zapier for workflow automation

-

Google Data Studio for live KPI dashboards

-

Calxa, Fathom or Modano for scenario forecasting

Together, these tools create a full-stack finance ecosystem that scales — giving founders clarity on cash flow, performance, and compliance in one view.

Case study: from ABN to investor-ready

A Melbourne SaaS founder began trading as a sole trader, earning $200k in year one.

By the second year, with growth accelerating, 42 Advisory guided a restructure to a Pty Ltd company.

Results:

-

Tax liability reduced by 28%

-

Access to the R&D tax offset

-

Clean equity structure ready for seed investment

What started as a compliance update became a strategic foundation for growth.

Crypto and Web3 startups: special considerations

For founders operating in crypto, DeFi, or digital asset sectors, taxation becomes even more complex.

The ATO now treats:

-

Token swaps, staking, and liquidity pool rewards as taxable events

-

Business-held crypto differently from personal investments

42 Advisory’s crypto accountants specialise in helping Web3 founders structure entities correctly — ensuring accurate record keeping, clear cost bases, and compliant reporting without unnecessary tax exposure.

Learn more - Crypto Tax Australia: The Ultimate Guide 2026

What does an investor-ready restructure look like in practice?

An early restructure from ABN to Pty Ltd can cut tax leakage, unlock R&D offsets, and create a clean cap table investors can diligence quickly.

Pattern we see in Melbourne startups:

A founder starts under an ABN, gains traction, then raises or hires—only to discover:

-

Contracts were signed in the wrong name

-

IP sits with the individual (or is unclear)

-

Equity is difficult to issue cleanly

-

Reporting is not investor-grade

An “investor-ready” restructure is rarely just paperwork. It usually includes:

-

Entity restructure plan (and roll-over eligibility where relevant)

-

Contract and bank clean-up (entity alignment)

-

Cap table and equity documentation readiness

-

Reporting stack that produces consistent, auditable numbers

The right structure. The right support.

Choosing how your startup operates is more than paperwork — it’s about shaping how wealth is created, protected, and eventually realised.

At 42 Advisory, we combine technical tax understanding with commercial foresight to help founders build businesses that last.

✅ Ready to start?

Build your startup on solid ground.

Explore our Startup Accounting Advisory Services and book a complimentary strategy session.